O yoga, "apropriação cultural" que desrespeita as culturas em que se inspira, ou doutrinação em religiões do extremo-oriente?

Friday, September 30, 2016

Thursday, September 29, 2016

O que a ciência económica não compreende acerca do "deal"?

What Donald Trump Doesn’t Understand About ‘the Deal’, por Adam Davidson (New York Times):

Donald Trump loves the word ‘‘deal.’’ The book he released with a co-writer in 1987 to summarize his views of the world was called, of course, ‘‘The Art of the Deal.’’ His view of trade with China is summarized in this quotation from his speech announcing his candidacy for president: ‘‘When was the last time anybody saw us beating, let’s say, China, in a trade deal? They kill us. I beat China all the time. All the time.’’ When asked last fall how he, as president, would guarantee health care for the uninsured, he answered, ‘‘I would make a deal.’’ He plans to make a deal with pharmaceutical companies to lower prices, make a deal with hospitals to treat the uninsured. On immigration, of course, he promises the greatest deal of all time, one that would compel Mexico to pay for a wall along its border with the United States. (...)Será que o problema aqui não estará mais na "Microeconomia 101" do que em Trump? O facto de em microeconomia, pelos vistos, não se falar de "deals" (expressão que não sei bem como traduzir - o mais parecido será "negócio", mas com a conotação específica de "negociar" ou "regatear", já que "negócio" também pode ter o significado geral de "atividade empresarial", o equivalente a "business" ) é provavelmente o resultado do "deal" fazer sentido sobretudo (como, aliás, está implícito nos parágrafos seguintes do artigo) em cenários de monopólio bilateral (ou do que eu chamei em tempos "concorrência monopolística bilateral"), em que ambas as partes do negócio têm características únicas, e em que portanto para aquele negócio específico se verificar têm que negociar até chegarem a um acordo. Das várias estruturas de mercado, o monopólio bilateral é provavelmente aquela que é menos aprofundada na microeconomia (pelo menos era no princípio dos anos 90), até porque é aquela que é mais difícil de formalizar por aquele método de definir umas funções, assumir que os agentes vão maximizar alguma coisa e depois calcular uma derivada (bem, o oligopólio também é difícil, se assumirmos - como provavelmente ocorre no mundo real, mas não nos modelos de Cournot e Stackelberg - que as várias empresas estabelecem a sua estratégia a pensar na reação das outras empresas), mas se calhar até é bastante frequente (p.ex, no mercado laboral para profissionais qualificados: quer cada posto de trabalho é relativamente único - juntando factores como localização, conteúdo funcional, etc. - quer cada trabalhador é também potencialmente único).

But tellingly, it’s also a set of issues for which the ‘‘deal’’ — that is, Trump’s unique ability to make deals — can be presented as his crucial promise.

The centrality of the ‘‘deal’’ to Trumponomics is especially strange when you consider how tangential that concept is, or at least should be, to a modern economy. In Microeconomics 101, deals are an afterthought: Transactions have the most socially optimal outcome when buyer and seller reach a mutually beneficial agreement. The very idea of a ‘‘good’’ deal for one party and a ‘‘bad’’ deal for another suggests a suboptimal outcome; an economy built on tough deal-making, with clear winners and losers, will always be a poorer one. Meanwhile, in macroeconomics — which covers the big, broad issues that a president typically worries about — the concept of the ‘‘deal’’ hardly exists at all. The key issues at play in a national or global economy (inflation, currency-exchange rates, unemployment, overall growth) are impossible to control through any sort of deal. They reflect underlying structural forces in an economy, like the level of education and skill of the population, the productivity of companies, the amount of government spending and the actions of the central bank.

http://www.nytimes.com/2016/03/20/magazine/what-donald-trump-doesnt-understand-about-the-deal.html?_r=1

Publicada por

Miguel Madeira

em

16:53

0

comentários

![]()

![]()

Monday, September 26, 2016

Cenários para as eleições norte-americanas

How Trump Might Win, por Ross Douthat (New York Times):

Now let me turn the screw a little further. The American Electoral College is an unusual system, and Trump is an unusual candidate. He’s likely to underperform among normal Republicans in many red states, where the white working class is already very Republican, by losing white suburban professionals who voted for John McCain and Mitt Romney. But he might overperform in Rust Belt states where the white working class is still a residually liberal swing vote, and where there are a lot of disaffected independents who sat out 2012. (That’s probably how you can have state polls showing strikingly close races in Republican strongholds like Georgia and Arizona, even though Trump is quite competitive in swing states like Ohio.)How Trump Could Win The White House While Losing The Popular Vote, por David Wasserman (FiveThirtyEight):

This unusual combination — underperforming but still probably winning Republican states, possibly overperforming in purple states — suggests a true black swan endgame: Not Trump 44, Clinton 43, but Clinton 45, Trump 43 … except that Trump, with his Rust Belt strength, loses a lot of reliable deep-red votes he doesn’t need and turns out just enough nonvoters in a few key swing states to take the Electoral College 270-268.

No, it’s not likely. No, don’t freak out.

But for this race to end with a huge Electoral College crisis is the kind of outcome everything that’s happened in 2016 almost — almost — leads one to expect.

Several of Trump’s worst demographic groups happen to be concentrated in states, such as California, New York, Texas and Utah, that are either not competitive or that aren’t on Trump’s must-win list. Conversely, whites without a college degree — one of Trump’s strongest groups — represent a huge bloc in three blue states he would need to turn red to have the best chance of winning 270 electoral votes: Florida, Ohio and Pennsylvania.[Via The American Conservative]

A repeat of 2000’s split verdict — except with more potential to plunge this much more polarized and anxious country into chaos — is still not very likely. Right now, the FiveThirtyEight polls-only model posits a 6.1 percent chance of Trump winning the Electoral College while losing the popular, and a 1.5 chance of the reverse outcome. But that’s not so remote, either, and if the national ballot were ever to tighten further, both “crazy” scenarios’ odds could rise. (...)

Don’t get me wrong: This scenario is still very unlikely. But its potential to plunge an already fraught election into absolute chaos means it shouldn’t be discounted, either.

Ainda a respeito disso, o que eu escrevi há quatro anos sobre uma crise institucional nos EUA (a partir de "Já agora, o meu cenário...") e o que Arnold Klin escreveu sobre uma guerra civil (note-se que isso era a pensar nas eleições de 2012).

Publicada por

Miguel Madeira

em

14:20

0

comentários

![]()

![]()

Thursday, September 22, 2016

A origem dos rumores sobre Obama "nascido no Quénia"?

The Secret Origins of Birtherism:

On February 28, 2008, UCLA Law Professor Eugene Volokh posted to The Volokh Conspiracy a short item where he stated that he was certain that John McCain was a natural-born citizen. At the time, there was some minor debate over whether McCain’s well-established birth in Panama affected his Presidential eligibility. In the comments thread to this post, one commenter, Dave N, posited this legal scenario:[Via Jesse Walker, Reason]

Let’s change the hypothetical (just for grins and giggles).Barack Obama’s father was a citizen of Kenya. What would Senator Obama’s citizenship status (and Presidential eligibility) be if:1) He had been born in Kenya, but taken by his mother to the United States immediately after birth and then spent the rest of his life as he has subsequently lived it?2) He was born in a third country, and like my first hypothetical, immediately taken to the United States? Does that change the analysis?3) Would these results change if Senator Obama had been raised in a foreign country for any length of time before his mother returned with him to the United States?That was posted at The Volokh Conspiracy at 2:02 a.m. on February 29, 2008. Just over 24 hours later, FARS was sharing at FreeRepublic what he had “been told today” about Obama having been born overseas, but taken by his mother to the United States immediately after birth. All the details subsequently expressed in FARS’ version of the rumor are there in Dave’s legal hypothetical. And as a rumor, it shows no signs of having existed prior to February 29.

Thus, before it was a rumor that gave birth to a fringe movement, dozens of attempted lawsuits, and Donald Trump’s political career, Birtherism was borne out of nothing more than a legal hypothetical. No family confessions, no stories out of Africa, no investigative reporting, no Hillary Clinton campaign sabotage. Just a mere thought exercise about citizenship law, turned into a malicious rumor by an anti-Muslim blogger.

That is how Birtherism was conceived.

Publicada por

Miguel Madeira

em

10:10

0

comentários

![]()

![]()

Tuesday, September 20, 2016

A crise venezuelana (II)

De facto a opção entre fixar taxas de câmbio e deixá-las flutuar é uma questão bastante única na forma como ela passa por cima das linhas ideológicas tradicionais. Entre os defensores das taxas de câmbio fixas estão tanto conservadores - que anseiam pela volta de algo que se pareça com o padrão-ouro - quanto [parte da esquerda], que não [concorda] que se deixem as taxas de câmbio à mercê dos mercados especulativos. Entre os defensores das taxas de câmbio flexíveis, estão monetaristas, que querem que os seus países sigam regras monetárias rígidas, e keynesianos, que querem taxas livres para que se chegue ao pleno emprego tanto (Paul Krugman, Vendendo Prosperidade)Há tempos, o João Vasco sugeriu-me que escrevesse mais qualquer coisa sobre a crise na Venezuela.

Bem, cá vai: na minha opinião o que está a acontecer na Venezuela é o que acontece quando combinamos um governo de esquerda com câmbios fixos sobre-valorizados (um governo de direita com câmbios sobrevalorizados dá a Argentina na viragem do século).

Para manter um câmbio fixo com a moeda de outro país, o banco central tem que ter uma reserva de moeda estrangeira que lhe permita trocar a sua moeda por moedas estrangeiras sem desvalorizar (há um conjunto de expressões - "divisas", "fuga de capitais", etc. - que os leitores mais velhos se lembrarão, sobretudo do período pré-CEE, e que no fundo fazem parte do mundo dos câmbios fixos: "divisas" são as reservas de moeda estrangeira detidas pelo banco central; "fuga de capitais", na prática, consiste em operações financeiras que, ao trocar moeda nacional por estrangeira, diminuem as reservas de moeda estrangeira detidas pelo banco central; as exportações são invariavelmente apresentadas como um meio de "obter divisas", etc.)

O que acontece quando, sobre um governo de esquerda e câmbios fixos, há uma situação em que a moeda nacional está artificialmente valorizada, tornando as exportações demasiado caras e as importações demasiado baratas, e levando assim a que se importe muito mais do que se exporte?

Sendo um governo de esquerda, supostamente não vai fazer políticas de austeridade para arrefecer a economia e assim reduzir as importações; assim, nos primeiros tempos as reservas de divisas do banco central vão-se esvaziando, para pagar as importações.

Chega uma altura em que as reservas se tornam tão pequenas que se torna necessário limitar as importações; isso pode ser feito abertamente, pondo limites quantitativos e qualitativos às importações (foi o que aconteceu na Grécia no verão passado, em que foi criado um comité especial de emergência para autorizar qualquer importação: note-se que nessas semanas, a Grécia tornou-se na prática um pais com uma moeda própria - já que os euros em circulação na Grécia deixaram de ser livremente convertíveis com os euros em circulação no resto da Europa - mas com câmbio fixo - já que o "euro grego" continuou a valer nominalmente o mesmo que o "euro europeu"), mas muitas vezes é feito de forma subretícia, simplesmente atrasando os despachos favoráveis aos pedido para trocar bolivares ou escudos por dólares e apresentando um problema financeiro como sendo apenas um problema administrativo de "demasiada burocracia" (em Portugal, penso que o sistema de limitar as importações era exigir que quem importasse tivesse que preencher um formulário especial - o "Boletim de Registo de Importações" - e depois imprimir uma quantidade limitada desses impressos).

A limitação (aberta ou encapotada) das importações tende a produzir uma escassez no mercado de produtos importados, e em principio ao aumento dos preços (lei da oferta e da procura em ação); por outro lado, tende também a levar a situações em que "conhecer alguém no Ministério" pode ser decisivo para uma empresa conseguir importar produtos (suspeito que isso funcionará ainda mais nos sistemas de limitação subretícia das importações, em que dá mesmo jeito ter um amigo que faz o pedido passar para cima na pilha de documentos para autorizar).

Frequentemente o aumento dos preços leva a decretos congelando-os, mas isso só agrava ainda mais a escassez.

No final, o governo acaba por desvalorizar a moeda, mas aí já é tarde e a curto prazo o único efeito da desvalorização é subir ainda mais os preços.

Ou seja, uma situação de escassez de bens importados e/ou inflação brutal, que parece-me ser exatamente o que está a acontecer na Venezuela (aqui, penso que o que originou a sobre-valorização foi a queda do preço do petróleo, que diminuiu o valor das exportações, e assim levou a que a atual cotação bolivar-dólar deixasse de ser sustentável).

No caso de um governo de direita a segurar um câmbio fixo sobrevalorizado, o resultado costuma ser os bancos centrais a subirem as taxas de juro para atraírem capitais estrangeiros, e assim lançando a economia numa recessão quase permanente.

De novo, não é raro que no fim o governo acabe por desvalorizar a moeda, mas também aí é já tarde e a curto prazo o único efeito da desvalorização e juntar ao desemprego uma subida de preços (creio que a crise argentina foi mais ou menos assim).

Ou seja, o resultado de câmbios sobrevalorizados + políticas de esquerda é uma crise do lado da oferta, com escassez de produtos; já para câmbios sobrevalorizados + políticas de direita o resultado é uma crise do lado da procura, com desemprego e falências em cadeia.

Publicada por

Miguel Madeira

em

09:01

1 comentários

![]()

![]()

Monday, September 19, 2016

Pela n-ésima vez, afinal o que é a classe média?

Ganho 2 mil euros, sou classe média? E eu que ganho 800? Nem os partidos sabem (Observador).

Publicada por

Miguel Madeira

em

10:00

0

comentários

![]()

![]()

Wednesday, September 14, 2016

Os robots vão substituir o trabalho?

Robotics or fascination with anthropomorphism, por Branko Milanovic:

Recent discussions about the “advent of robots” have some rather unusual features. The threat of robots replacing humans is seen as something truly novel possibly changing our civilization and way of life. But in reality this is nothing new. Introduction of machinery to replace repetitive (or even more creative) labor has been applied on a significant scale since the beginning of the Industrial Revolution. Robots are not different from any other machine.Dessas "falácias", a que me parece menos falaciosa ainda é capaz de ser a última (as duas primeiras parecem-me logicamente erradas, enquanto a terceira pode ser empiricamente falsa, mas em teoria poderia ser perfeitamente verdadeira).

The obsession with, or fear of, robots has to do, I believe, with our fascination with their anthropomorphism. Some people speak of great profits reaped by “owners of robots”, as if these owners of robots were slaveholders. (...) It could happen that the distribution of net product will shift even more toward capital, but again this is not different from the introduction of new machines that substitute labor—a thing which has been with us for at least two centuries.

Robotics leads us to face squarely three fallacies.

The first is the fallacy of the lump of labor doctrine that holds that the new machines will displace huge numbers of workers and people will remain jobless forever. Yes, the shorter our time-horizon, the more that proposition seems reasonable. Because in the short term the number of jobs is limited and if more jobs are done by machines fewer jobs will be left for people. But as soon as we extend our gaze toward longer-time horizons, the number of job becomes variable. We cannot pinpoint what they would be (because we do not know what new technologies will bring) but this is where the experience of two centuries of technological progress becomes useful. We know that similar fears have always existed and were never justified. (...)

The second “lump” fallacy which is linked with the first, namely our inability to pinpoint what new technology will bring, is that human needs are limited. The two are related in the following way: we imagine (again, looking only at any given moment in time) that human needs are limited to what we know exists today, what people aspire to today, and cannot see what new needs will arise with a new technology. Consequently we cannot imagine what will be the new jobs to satisfy the newly created needs. (...)

The third “lump” fallacy (which is not directly related to the issue of robotics) is the lump of raw materials and energy fallacy, the so called “carriage capacity of the Earth”. There are of course geological limits to raw materials simply because the Earth is a limited system. But our experience teaches us that these limits are much wider than we generally think at any point in time because our knowledge of what earth contains is itself limited by our level of technology.

Publicada por

Miguel Madeira

em

12:23

1 comentários

![]()

![]()

Thursday, September 08, 2016

"O Caminho das Estrelas"

Há 50 anos atrás, a 8 de setembro de 1966, era transmitido nos EUA o primeiro episódio de Star Trek.

Quando tinha para aí uns 7 anos, era um dos pontos altos da minha rotina semanal.

Publicada por

Miguel Madeira

em

09:58

0

comentários

![]()

![]()

Wednesday, September 07, 2016

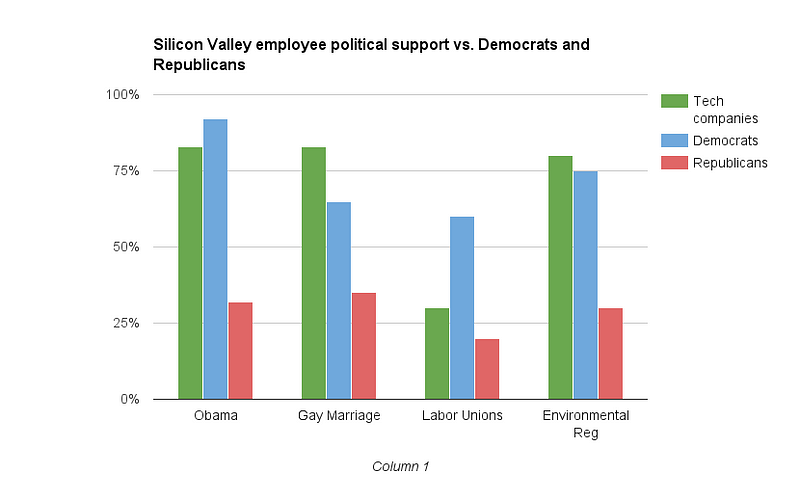

As tendências políticas de Sillicon Valley

Silicon Valley’s Political End Game (In 15 Charts) **VERY EARLY DRAFT**, por Greg Ferenstein:

This post is a graphic summary of an upcoming data-driven book on Silicon Valley’s political end game: the path toward overhauling the Democratic Party and orienting our lives toward innovation. (...)

Tech companies, both founders and employees, are overwhelmingly Democratic; However, they don’t fit the pro-union Democratic stereotype. We can’t really fit them into a pre-existing bucket

Publicada por

Miguel Madeira

em

15:24

0

comentários

![]()

![]()

O distributismo é o futuro?

Distributism Is the Future, por Gene Callaham (The American Conservative):

Distributism is the rather awkward name given to a program of political economy formulated chiefly by G.K. Chesterton and Hilaire Belloc, two of the most prominent English writers of the early 20th century. Both Catholics, they sought to turn the social teaching of Popes Leo XIII and Pius XI into a concrete program of action. They rejected socialism, believing that private property was an essential component of human flourishing, but they also rejected the existing capitalist system as concentrating private property in far too few hands.(...)When “Chesterbelloc”—as G.B. Shaw named the pair—talked about property, their focus was on capital goods, not consumption goods. They would not be impressed by arguments showing that, while American workers may be totally dispossessed of the means of production, at least they have 40-inch LCD televisions and smart phones. (...)But if that is so, what direction should we head? The one recommended by the distributists sought to combine the best elements of various other visions of political economy.Distributism shares with Marxism the goal of the workers owning the means of production and of eliminating the alienation of the worker from his product. (Of course, distributists meant that the workers should really own the means of production—not, as communists usually did, that the workers should “own” them through the intermediary of the state.) And distributist class analysis resembles Marxist class analysis in obvious ways.Along with free-market economists, however, distributists recognize the importance of private property. Further, modern distributists recognize the crucial role of something that early advocates such as Chesterton and Belloc did not have the theoretical resources to articulate: namely, the vital role of true market prices in achieving economic efficiency. As Friedrich Hayek put it, market prices are able to incorporate knowledge of the “particular circumstances of time and place” into a worldwide economic system.Distributism also contains aspects of communitarianism: with capital owned on a local level, owners are more likely to engage with the social and civic life of their community. Chesterton liked to refer to distributism as “real democracy.”And finally—something that Belloc stressed—distributism has a conservative aspect: it posits as a laudable end not some utopian experiment in untested social arrangements but a socio-economic system that we already know is workable, from both historical and contemporary evidence. Furthermore, because workers themselves are the owners of capital goods, they are less likely to be forced to abandon their communities and extended families in order to keep a good job. There of course may be efficiency trade-offs in choosing to stay put rather than moving to some distant but more profitable location to find some work. But under distributism, workers would evaluate these trade-offs for themselves, rather than having some global corporate entity send them, willy-nilly, thousands of miles from their family and community—or finding themselves suddenly unemployed, as the modern corporation is loath to give its workers even a moment’s notice before they are escorted out of their workplace and onto the street by corporate security.

Publicada por

Miguel Madeira

em

10:12

1 comentários

![]()

![]()

Tuesday, September 06, 2016

O fim do casamento, do capitalismo e da religião?

This is the end of marriage, capitalism and God. Finally!, por Jeff Degraff (Salon):

The next big thing isn’t a clever gadget or miracle drug—it’s a way of life: not a breakthrough invention but a social innovation. And it’s not so much a beginning as it as a series of endings.Rising numbers of young people are now deciding to do everything their parents didn’t. They’re eschewing cultural and economic convention to challenge what we take to be civil society. They aren’t marrying. They’ve become the refuseniks of our competitive corporate culture. And many of them have opted out of organized religion. (...)

According to the New York Times, over half of all American women under 30 who give birth are unmarried. When adjusted for levels of education and economics, the numbers skew dramatically higher. (...)

What were once areas of blight are now shining lights for our youth. Signs of the new anti-commercialism are everywhere: shared houses and cars, urban farm collectives, and the end of intellectual property rights. Millennial survival guides abound in the form of countless blogs that offer advice on how to hack the new world. Pass the beer nuts, comrade.Time went so as far as to call millennials the “Me Me Me Generation.” While tons of readers disapproved of the essay’s snarky tone, what the essay really missed is the collaborative nature of this age group. There is a noticeable shift away from traditional careers in favor of values-centric goals of communal harmony. For example, a much larger percentage of recent college graduates now seek work in the nonprofit sector than graduates in the previous four decades.(...)

According to the Washington Post, 25 percent of millennials don’t affiliate with a faith-based tradition and almost twice as many don’t belong to a church. More so, a Pew Research study suggests that an astonishingly low number of youth believe in the existence of a God. As religious participation, affiliation and even belief wane in both post-Christian Europe and the Americas, atheism is now among the fastest-growing affiliations among young adults who have turned anti-faith into its own kind of faith.

Publicada por

Miguel Madeira

em

15:06

0

comentários

![]()

![]()

Legalização da cannabis e mortes por overdose de analgésicos

States With Medical Marijuana Have Decreased Painkiller Deaths By Dramatic Amounts (Collective Evolution):

Throughout the United States, prescription drug overdoses have been a major problem. But now, with the rise of medical marijuana in many states, the number of deaths from pharmaceutical painkillers is on the decline.[Via LewRockwell.com]

Deaths caused by prescription of Opioid (opium), Vicodin, and OxyContin have approximately tripled since 1991, and every day 46 people die of such overdoses in the United States. However, in the 13 states that passed laws allowing for the use of medical marijuana between 1999 and 2010, 25 percent fewer people die overdoses of opioid drugs each year.

Publicada por

Miguel Madeira

em

09:55

0

comentários

![]()

![]()